Aluminium recycling is one of the most energy-efficient industrial processes using up to 95% less energy than producing aluminium from bauxite. In fact, recycling one tonne of aluminium saves 8 tonnes of bauxite, 14,000 kWh of energy, 40 barrels of oil, and 7.6 cubic meters of landfill space.

Even a single recycled aluminium can is powerful enough to run a 100-watt bulb for almost four hours, highlighting the extraordinary efficiency of this material.

As India accelerates its sustainability goals, the aluminium recycling ecosystem is expanding rapidly—driven by automotive, construction, electrical, packaging, and infrastructure growth. Businesses and individuals are increasingly searching for aluminium scrap buyers, reliable processors, and organised recyclers.

Whether you’re looking for aluminium scrap importers in India or evaluating the broader scope of aluminium recycling, understanding the ecosystem helps maximise value and tap into a future-ready market.

Who Buys Aluminium Scrap in India?

The market for aluminium scrap is supported by a diverse set of aluminium scrap buyers, each playing a key role in India’s circular economy:

1. Refiners and Remelters

These buyers convert aluminium scrap into high-purity ingots, slabs, or billets. Because of their large-scale operations, they seek consistent volumes of clean, sorted scrap and often supply to high-tech industries requiring premium alloys.

2. Manufacturers

Automotive, construction, infrastructure, consumer goods, and packaging manufacturers purchase recycled aluminium to reduce costs and lower their carbon footprint. Their need for lightweight, durable and eco-friendly materials keeps demand steady.

3. Scrap Merchants and Processors

Often the first touchpoint for individuals selling scrap, these intermediaries collect, sort, and supply scrap to larger recyclers. Their networks form the backbone of the local collection ecosystem.

4. Government Agencies

Disposed or auctioned government scrap – vehicles, electrical parts, and outdated machinery also enters the recycling chain through authorised channels.

Together, these groups create strong and growing demand among aluminium scrap buyers across India.

How Aluminium Recycling Works?

Here’s a simplified overview of aluminium recycling in India:

1. Collection (New vs Old Scrap)

Aluminium scrap comes from two key sources:

- New scrap: Clean manufacturing leftovers like sheet cuttings and extrusion offcuts. Since their composition is known, smelters can recycle them directly.

- Old scrap: Used beverage cans, window frames, cables, vehicle parts, etc. These require sorting and cleaning due to contamination.

Scrap is collected from households, industries, scrap dealers and municipal systems.

2. Sorting

Scrap is separated into coated(painted/lacquered) and uncoated aluminium. Contaminants like plastic, paper, steel and dust are removed.

3. Pre-Processing

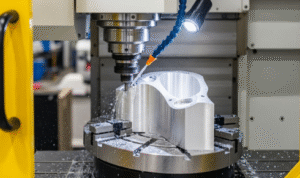

The sorted scrap is baled, cleaned, and shredded to reduce size and remove oils, chemicals, and coatings. Advanced plants use thermal or mechanical decoating systems for maximum purity.

4. Melting and Re-Alloying

- Uncoated scrap goes straight into remelter furnaces.

- Coated scrap is first processed in a rotary furnace before melting.

Impurities like steel are skimmed off. Recyclers then adjust alloy compositions to meet industry-specific standards, supported by spectrometric and tensile testing.

5. Casting

Molten aluminium is cast into ingots, billets or slabs, or supplied directly as liquid metal to manufacturers, thereby eliminating re-melting and saving energy and cost.

Profitability of Aluminium Scrap Recycling

Running a successful aluminium recycling operation depends on three critical factors:

#1: Market Prices and Demand

Aluminium scrap pricing follows global trends. When demand increases in automotive, infrastructure, or EV sectors, margins strengthen. India’s aluminium consumption growth ensures a long-term, stable market for recyclers. Industry reports estimate that the global aluminium recycling market will surpass USD 120 billion by 2030, growing at a CAGR of around 7% between 2025 and 2030, signalling sustained long-term profitability.

#2: Quality of Recycled Output

Higher-quality recycled aluminium fetches premium prices and unlocks access to specialised sectors like aerospace, electronics, and high-performance automotive components.

#3: Operational Efficiency

Energy consumption during melting, transportation costs, labour, and plant efficiency directly impact profitability. Well-run facilities maintain healthy margins even during price volatility.

Businesses that optimise logistics, upgrade technology, and maintain consistent scrap quality typically achieve the highest profit margins.

The Future of Aluminium Recycling in India

India’s aluminium demand is projected to soar due to urbanisation, renewable energy expansion and the rise of electric mobility. This makes aluminium recycling essential not just for business, but for national resource security.

In this evolving landscape, large integrated recyclers play a pivotal role. Jain Metal Group, one of the most established names in India’s non-ferrous recycling industry, continues to expand its aluminium recyclingcapabilities alongside copper, lead, cable, and multi-material recycling.

With advanced technology, end-to-end processing, and global sourcing expertise, the Group is helping shape a future where efficient aluminium recycling strengthens India’s circular economy while supporting sustainable industrial growth.