Let’s be real—starting a business is hard, but letting go? That’s a different kind of difficult. Maybe you’ve spent years pouring energy, money, and caffeine-fueled nights into building something from scratch. Or maybe you took the reins of a family-owned business and turned it into something new. But now… something’s shifting.

You’ve got that nagging thought in the back of your mind: “What’s next for me?” Whether you’re craving more time with family, itching to try something new, or just tired of the grind, figuring out how to exit your business without unraveling everything you’ve built is a process that demands both heart and strategy.

That’s where the idea of an exit strategy session becomes more than just jargon. It’s the quiet room you finally sit in to breathe, look around, and map out how to leave without leaving chaos behind. It’s not only about packing up shop—it’s about protecting your legacy, your people, and, yes, your wallet.

It’s Not Just a Sale, It’s a Transition

Selling your business isn’t like selling a used car. You don’t just slap a price tag on it and call it a day. There are emotions involved—fear, excitement, maybe even guilt. That’s why good sell business advice doesn’t start with dollar signs. It starts with questions.

Who will take over? Will your employees be okay? Is now even the right time? Do you need to sell outright, or is there room for a phased handoff?

Too often, people think selling is just about finding a buyer. But the smartest moves are made months—sometimes years—before any actual transaction. The legal, financial, and operational pieces all need to align. And don’t forget the personal stuff. Are you ready to step away?

Don’t Guess Your Worth—Know It

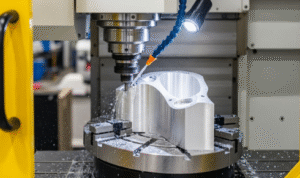

One of the biggest mistakes business owners make is underestimating their company’s value—or overestimating it. Both are equally dangerous. That’s why scheduling a valuation consultation with a qualified expert should be right up there with talking to your attorney or accountant.

Let’s be honest: you’re biased. It’s your baby. And while pride in your work is healthy, it can cloud your judgment when you’re pricing your business. A proper valuation looks past your sentimental attachments and digs into the nuts and bolts: cash flow, recurring revenue, client concentration, market positioning, and more.

And no, a back-of-the-napkin calculation doesn’t count. You need someone with experience, data, and objectivity.

Timing Isn’t Everything—But It Matters

There’s this myth that the “perfect time” will just reveal itself, like some flashing neon sign that says, “Sell now!” But reality rarely works that way.

Sure, market conditions play a role. But so do your personal circumstances. Some of the most successful exits happen not because of market highs, but because the owner was prepared, intentional, and had the right people advising them.

A solid transition plan looks at short- and long-term tax implications, your team’s future, and whether your business can survive (and thrive) without you.

Remember, your identity may be tied to this business, but you are not your business. You’re allowed to imagine a life beyond it.

People First, Always

This part often gets overlooked. Your team, your clients, your vendors—they’ve all been part of the journey. An ethical, graceful exit considers what happens to them, too.

Don’t disappear. Communicate. Whether it’s a quiet conversation with your leadership team or a public announcement to your loyal customers, own the narrative.

If you’ve built a culture worth preserving, help ensure it continues after you’re gone. That legacy may be worth more than any check you cash.

So, What Comes After?

Here’s the curveball no one prepares you for: the moment after the deal closes.

Some owners feel relief. Others feel… lost. You might wake up on a random Tuesday and think, “Well, now what?” That’s okay. It’s normal. You just need to give yourself space to rediscover who you are without a title, payroll, or 6 a.m. staff meetings.

And if you ever get the itch to start something new? Go for it. But do it on your own terms, with fresh eyes and fewer blind spots.

Final Thoughts

Exiting your business doesn’t have to feel like closing a chapter. It can be the start of something else—maybe even something better. But only if it’s done with care, clarity, and intention.